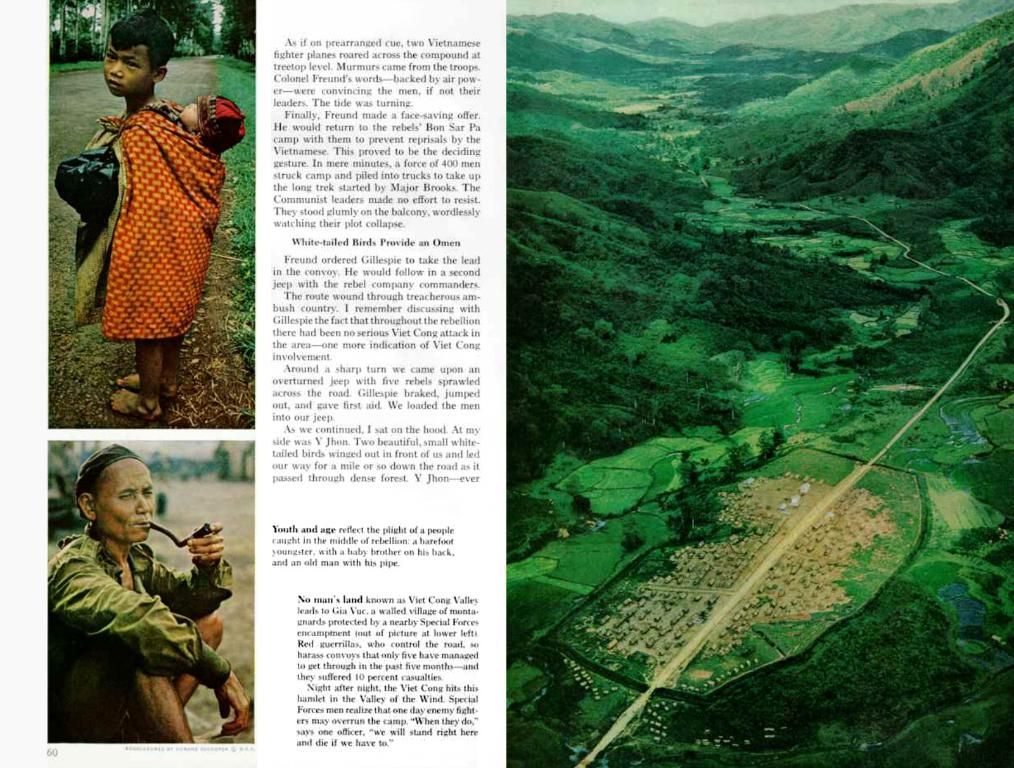

Clash of Perspectives Among Different Age Groups

Tackling the Generational Pension Quandary: A Closer Look at Financial Education and Occupational Pensions

The ongoing debate surrounding the supposed generational conflict in pensions has grabbed headlines. The crux of the issue: older individuals struggle to make ends meet due to the pay-as-you-go system, while the younger generation faces the burden of contributing more and may not reap the benefits as a result of demographic changes and aging. However, the Metallrente Youth Study asserts an unexpected finding: young people aren't primarily responsible for this divide. Economist Christian Traxler, speaking at the Federal Press Conference, confirmed this assertion: "On the contrary, our results show great solidarity between the generations."

Young people, aged 17 to 27, have surprising preferences for securing their future: they demand higher contributions and increased federal funding for tax subsidies, rather than cutting current pensions or raising the retirement age. This solidarity, stemming from a desire for financial security in old age, is often overshadowed by the reality of their limited financial knowledge.

Metallrente, an industry pension scheme, aims to promote occupational pensions and increase awareness of financial education. Along with statutory and private provisions, occupational pensions form one of the three pillars of the pension system, and employees are entitled to income conversion, with parts of their salary or wages saved for future company pensions.

According to the survey, 88 percent of respondents expressed interest in saving, with 54 percent eying retirement as their saving goal. Interest in traditional savings methods, like savings books, is dwindling, while the Riester pension, once popular in 2010, is now used by a mere 17 percent. Trust in the statutory pension has also slightly decreased over the years due to political uncertainties.

Fintechs and technologically advanced financial innovations have gained traction since 2016, with 62 percent of young people investing in stocks and funds. However, 96 percent of young people view a lifelong pension performance as an effective old-age provision, often questioning the safety of stock pensions. A staggering 55 percent of respondents were unfamiliar with the correlation between high returns and high risks, while only 54 percent understood the concept of diversification – risk minimization through asset distribution.

Economist Carmela Aprea from the University of Mannheim laments the shockingly low level of financial literacy among this age group. Women, in particular, often struggle to answer financial knowledge questions, revealing a strong sense of insecurity that may reinforce existing financial inequalities between the sexes. "This underscores the need for appropriate financial education," Aprea claims, echoing the call for change. Germany currently stands as the only OECD country without a financial education strategy.

Those young people who haven't independently saved for retirement often cite a lack of funds as the primary reason. The focus, however, shouldn't be on the supposed generational problem in Germany, but on the distribution problem.

The SPD-CDU government plans to bolster statutory pension benefits through incentives for longer working hours. However, labor market experts, like Yvonne Lot from the trade union-affiliated Hans-Boeckler-Foundation, fear that these measures may exacerbate existing inequalities to the detriment of women and those in the heavy labor sector, who are often unable to work due to care work and high workloads.

In light of these findings, a strategic approach centered on financial education and occupation pensions is needed to create a brighter future for the younger generation and secure the stability of the statutory pension system. This approach might include government policies supporting financial education, collaboration between private and public sectors, and incentives for employers to offer robust retirement plans. With improved financial literacy and occupational pension offerings, Germany can better equip its younger citizens to face the challenges ahead and secure their financial future.

Steer your financial journey with our weekly newsletter nd.DieWoche. Subscribe for free to stay informed about the week's most crucial topics and discover the highlights of our Saturday edition! 🔒Subscribe Now

Financial Education and Occupational Pensions in Germany: Enhancing Strategies for Stabilizing the Statutory Pension System

- Enhanced Financial Literacy: Financial education plays an essential role in preparing young people with the necessary knowledge to make informed decisions about their retirement savings, encouraging early investment and understanding compound interest.

- Awareness of Retirement Challenges: Financially educating young people about the challenges facing the statutory pension system—such as the decreasing worker-to-pensioner ratio—can motivate them to supplement their retirement savings with private or occupational pensions.

- Promoting Diversified Investments: By emphasizing the benefits of diversifying investments beyond traditional savings accounts and encouraging participation in capital markets, financial education can help young people capitalize on higher returns over the long term.

- Auto-Enrollment and Auto-Escalation: Implementing features like auto-enrollment and auto-escalation in occupational pension plans can increase participation rates among employees and reduce the psychological barriers associated with saving for retirement.

- Integrating Annuities: Incorporating options like annuities into occupational pension plans can provide workers with predictable income streams in retirement, allowing for improved financial stability and reductions in the burden on the statutory system.

- Collaboration between Private and Public Sectors: Encouraging collaboration between private financial institutions and public entities can lead to more effective financial education programs and occupational pension offerings, ultimately strengthening the statutory pension system as a whole.

By focusing on financial education and occupational pensions, Germany can better prepare its younger generation for retirement, securing the long-term stability of its statutory pension system.

- Financial education is crucial in equipping young people with the necessary knowledge to make informed decisions about personal-finance and retirement savings, encouraging early investment and understanding compound interest.

- Awareness of the challenges facing the statutory pension system, such as the decreasing worker-to-pensioner ratio, can motivate young people to supplement their retirement savings with private or occupational pensions.

- Emphasizing the benefits of diversifying investments beyond traditional savings accounts and encouraging participation in capital markets can help young people capitalize on higher returns over the long term.

In addition, implementing features like auto-enrollment and auto-escalation in occupational pension plans, incorporating options like annuities into such plans, and encouraging collaboration between private financial institutions and public entities can lead to more effective financial education programs and occupational pension offerings, ultimately strengthening the general-news and politics of the German statutory pension system.