Boosting Insurance Knowledge and Understanding for Smarter Choices

In today's complex financial landscape, community initiatives and online learning platforms are proving to be effective resources in enhancing insurance literacy. This vital education equips individuals with the knowledge and skills necessary to understand insurance products and make informed decisions.

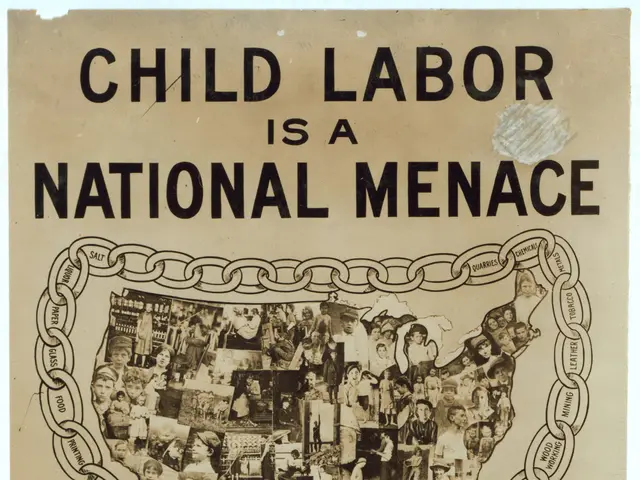

The intricacies of insurance products, often filled with jargon, can hinder consumers' understanding of essential concepts. However, understanding insurance law is crucial for consumers to protect their rights and make informed choices. This understanding is not just about deciphering terms and conditions, but also about comprehending legal rights during claims processes and being aware of consumer protection laws.

Key factors influencing the relationship between insurance law and literacy include knowledge of policy terms and conditions, understanding of legal rights during claims processes, and awareness of consumer protection laws. Enhancing insurance literacy significantly improves decision-making among consumers, enabling them to evaluate various insurance products and choose suitable coverage that aligns with their specific needs.

The rapid evolution of insurance laws and regulations poses a continual challenge in keeping educational content updated. Nevertheless, online learning platforms facilitate access to comprehensive materials covering various aspects of insurance law and concepts, making learning both convenient and efficient.

Real-life scenarios often illustrate the repercussions of inadequate literacy on insurance choices. For instance, homeowners who misunderstand policy coverage may face unexpected out-of-pocket expenses during claims. This underscores the importance of insurance literacy in fostering financial security and effective risk management.

Community initiatives, such as workshops, seminars, and informational sessions, are instrumental in raising awareness and engaging community members in discussions about various insurance topics. These initiatives bridge gaps in understanding, promote a well-informed populace, and contribute to overall financial well-being.

Socioeconomic factors can also play a role in the challenges of insurance education, as individuals from lower-income backgrounds may lack access to quality resources. Collaboration between financial institutions, educational organizations, and community groups is crucial for promoting insurance education and literacy.

Successful literacy programs, such as the National Association of Insurance Commissioners' "Insurance 101" program, provide educational resources to help consumers navigate insurance options effectively. The future of insurance education and literacy is poised for significant transformation, influenced by technological advancements and evolving consumer needs, with innovative learning methods, gamification, and interactive modules expected to enhance user engagement and retention.

Insurance literacy enables individuals to understand the terms, conditions, and legal implications of various policies. Improved insurance literacy fosters financial security and effective risk management, allowing individuals to identify potential risks and make informed decisions about coverage options that safeguard their financial future.

Read also:

- Executive from significant German automobile corporation advocates for a truthful assessment of transition toward electric vehicles

- Crisis in a neighboring nation: immediate cheese withdrawal at Rewe & Co, resulting in two fatalities.

- Financial Aid Initiatives for Ukraine Through ERA Loans

- Diagnosing Male Fertility Issues: A Guide to Understanding Male Fertility Evaluations