Bank of America Empowers Students with Financial Literacy Skills

Bank of America, through its Better Money Habits program, is empowering students to make informed financial decisions. The initiative, backed by the bank, aims to help students distinguish between wants and needs, a crucial skill for managing expenses during their academic journey.

Financial habits are largely learned behaviors, and not all students receive this education at home. Bank of America's Indy Cheema stresses the importance of financial literacy for students, highlighting that money should not be a barrier to higher education. To address this, the bank offers resources through Better Money Habits, equipping students with the tools to understand and manage their finances effectively.

Experts advise that students should learn to differentiate between their wants and needs. This understanding is vital for budgeting and making informed spending decisions. By mastering this skill, students can better manage their expenses and make the most of their financial resources.

Bank of America's Better Money Habits program is committed to improving financial literacy among students. By providing resources and emphasizing the importance of understanding wants versus needs, the bank is helping students navigate their financial journeys and making higher education more accessible.

Read also:

- Executive from significant German automobile corporation advocates for a truthful assessment of transition toward electric vehicles

- Crisis in a neighboring nation: immediate cheese withdrawal at Rewe & Co, resulting in two fatalities.

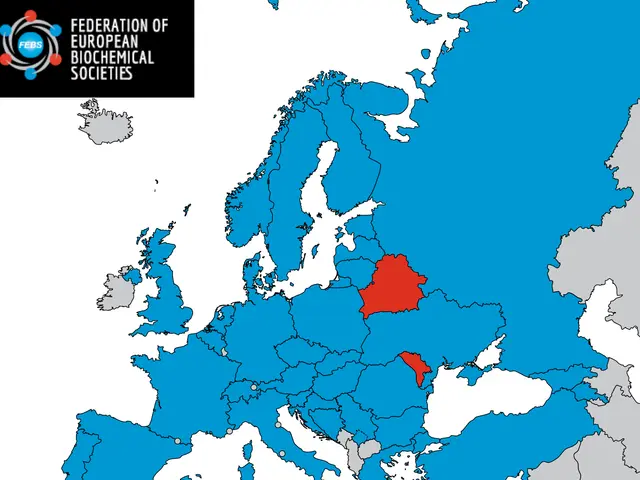

- Financial Aid Initiatives for Ukraine Through ERA Loans

- Diagnosing Male Fertility Issues: A Guide to Understanding Male Fertility Evaluations