"A collection of 25 strategies for earning income passively, intended to enhance your financial status in the year 2025"

Passive income, a continuous stream of earnings generated regularly and automatically, is becoming increasingly popular among individuals seeking financial independence. This form of income differs from active income where income is directly exchanged for time and effort.

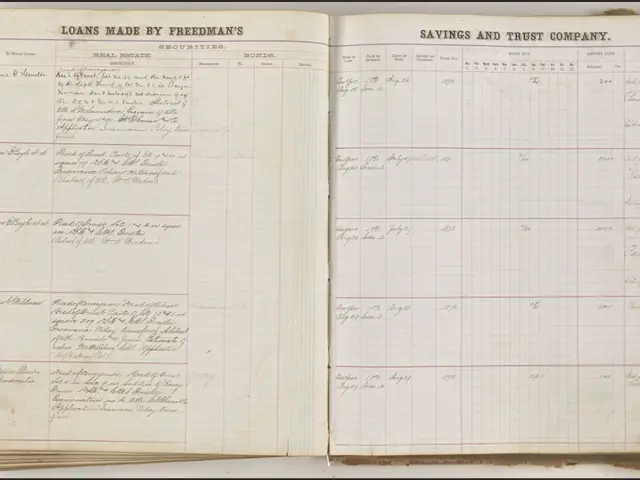

One way to tap into passive income is through Real Estate Investment Trusts (REITs). REITs are companies that own and manage real estate, providing a way for individuals to invest in real estate without the hassle of property management. You'll earn whatever the REIT pays out as a dividend. REITs have a special legal structure so that they pay little or no corporate income tax if they pass along most of their income to shareholders.

Another avenue for passive income is investing in dividend stocks, a bond ladder, high-yield CD or savings account, setting up an annuity, peer-to-peer lending, municipal bond closed-end fund, preferred stock, rental income, buying crowdfunded real estate, or REITs. Each of these options offers unique returns and risks, so it's essential to understand the details before investing.

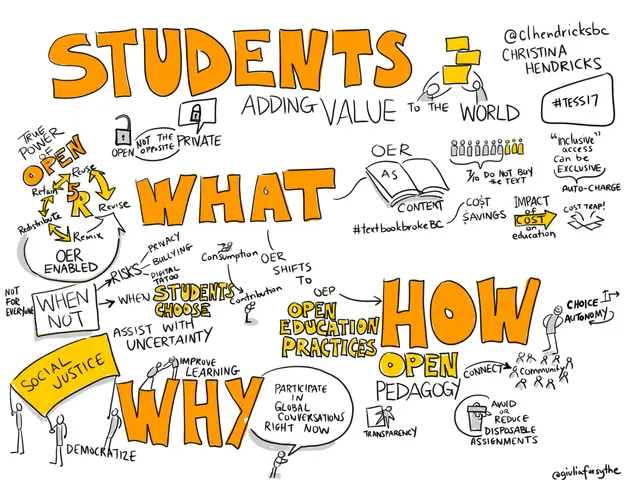

For creatives, passive income opportunities include writing an e-book, selling photography online, creating an app, starting a blog or YouTube channel, selling designs online, affiliate marketing, sponsored posts on social media, or creating a course. Building a strong platform, marketing your products, and planning for more products are crucial for success in these areas.

Affiliate marketing is a popular form of passive income. When a visitor clicks on a link on your site or social media account and makes a purchase from a third-party affiliate, the site owner earns a commission. Commission might range from 3 to 7 percent, so it will likely take significant traffic to your site to generate serious income.

Passive income can also come from renting out assets. Renting out your home short-term when you're away or traveling, renting out an idle parking space, or renting out useful household items like lawnmowers, power tools, or tents for cash are all viable options. In high-demand areas or during high-demand times, these assets could be worth real money.

However, it's important to note that while passive income may not involve extra work, it often requires initial work and ongoing maintenance. For example, when renting out a property, you'll need to ensure the property is well-maintained and that you have a reliable source of products when selling items online.

Passive income can provide extra cash flow during economic downturns or periods of unemployment, helping individuals save enough for retirement. It can also serve as a full-time income source after some time.

In conclusion, there are numerous passive income ideas available, depending on personal interests and expertise. Whether you're an investor, a creative, or a property owner, there's a passive income opportunity out there for you. Just remember that while passive income requires less ongoing effort, it often requires an initial investment of time, money, or both to set up sources such as capital investments, digital products, or renting out assets.

Read also:

- Executive from significant German automobile corporation advocates for a truthful assessment of transition toward electric vehicles

- Crisis in a neighboring nation: immediate cheese withdrawal at Rewe & Co, resulting in two fatalities.

- Financial Aid Initiatives for Ukraine Through ERA Loans

- Diagnosing Male Fertility Issues: A Guide to Understanding Male Fertility Evaluations